With the recent announcement of some higher-than-expected increases to medical cover products for 2017, many people are reconsidering their medical cover for the immediate future and re-assessing their financial plans to ensure that they are still working with the best portfolio for their lifestyles, their families and their businesses. Whilst the year-ahead increases will cause […]

Category Archives: Financial Planning

Teach your children about financial goals

Preparing your children for their financial future is one of the greatest gifts you can give them. For many parents, talking about money can be an uncomfortable subject and discussing finances with your children can feel both personal and scary, but they need to learn if they are to make wise decisions concerning their own […]

The power of positivity and a good plan

Have you ever told yourself, “When I have more money, I’ll be happier”? How about, “I’ll never be able to pay off this debt”? These sort of toxic money thoughts are holding you back from financial success – and happiness! A good financial plan needs to be attainable and measurable, those expressions are neither. The […]

Mid-Year Financial Review

When are you most likely to check on your investments? Is it when they are doing well, or is it when the markets are down and you’re feeling anxious? Chances are it’s the latter. This isn’t always the ideal time to make investment decisions as emotions are running high. That’s why taking the time to […]

Common financial mistakes in your thirties

Saving in your thirties becomes increasingly difficult as your financial responsibilities increase. However, sound financial decisions during this phase of life can have profound benefits at a later stage. Here are some common financial mistakes to avoid: The first is failing to draw up a budget. A proper budget is the starting point of all […]

Cards for kids | Teaching your child to manage a credit card

Basic financial learning curves are best learnt early in life, they will benefit you in your youth as well as in the future. Managing debt is one such important learning curve and a credit card is a transactional tool through which this experience can be gained. The sooner you teach your children to be disciplined […]

South Africans lack confidence when it comes to finances

Most South African consumers feel challenged by their finances, with relatively few saying that they are highly successful at sticking to their financial goals or are knowledgeable about financial matters.This was revealed when the Financial Planning Institute of Southern Africa (FPI) conducted a nationwide survey, in conjunction with the Financial Planning Standards Board (FPSB) and […]

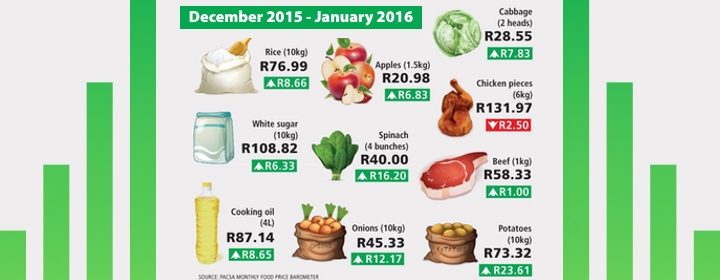

Food costs eating through our pockets

Certain provinces have been struggling to keep up with the skyrocketing cost of food. Current data points to an agriculture industry that is struggling, mainly due to the diminished buying power of the rand and a prolonged drought.November 2015 saw the worst drought in South Africa in 23 years. During this time Stats SA released […]

Retail Distribution Review – Prepare for advice fees

For the first time in South Africa, financial advice is set to become a billable service. Known as the Retail Distribution Review (RDR), the first phase will be implemented later this year (2016), introducing some significant changes for both consumers and financial advisors alike.As with all change, some sound preparation and a positive outlook will […]

Retirement tax reform

Also known as The Commutation of Benefits, there are some big changes coming for retirement and provident fund holders. Essentially, these all relate to how the money is drawn (commuted) or re-invested.After being delayed by a year, the Taxation Laws Amendment Act is being put into place on 1 March 2016 (‘T-day’). The legislation changes […]