It’s often said that the best years are the forties – and for so many reasons! Whilst everyone is different, it’s good to state at the start of this article that this perspective is becoming even more prevalent. Some forty year-olds are in their first marriage with kids, others are in their second or third… […]

Category Archives: Blog

Drawing up a Budget – Useful Tips

Nowadays, making a transaction can feel somewhat unreal. Just a swipe and a glance at the number displayed on a digital screen. Whilst this seems easy and practical, it poses a big problem that is too-often overlooked. When we stop dealing with physical coins and notes – a mental disconnect occurs between the digital numbers […]

Common financial mistakes in your thirties

Saving in your thirties becomes increasingly difficult as your financial responsibilities increase. However, sound financial decisions during this phase of life can have profound benefits at a later stage. Here are some common financial mistakes to avoid: The first is failing to draw up a budget. A proper budget is the starting point of all […]

Cards for kids | Teaching your child to manage a credit card

Basic financial learning curves are best learnt early in life, they will benefit you in your youth as well as in the future. Managing debt is one such important learning curve and a credit card is a transactional tool through which this experience can be gained. The sooner you teach your children to be disciplined […]

South Africans lack confidence when it comes to finances

Most South African consumers feel challenged by their finances, with relatively few saying that they are highly successful at sticking to their financial goals or are knowledgeable about financial matters.This was revealed when the Financial Planning Institute of Southern Africa (FPI) conducted a nationwide survey, in conjunction with the Financial Planning Standards Board (FPSB) and […]

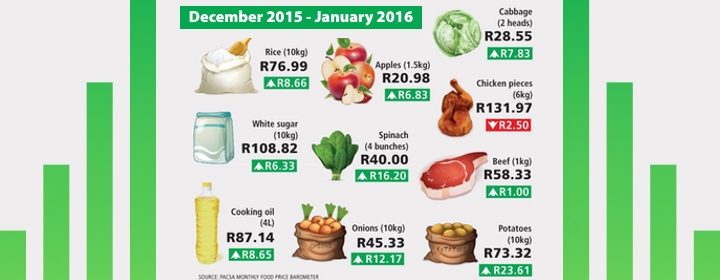

Food costs eating through our pockets

Certain provinces have been struggling to keep up with the skyrocketing cost of food. Current data points to an agriculture industry that is struggling, mainly due to the diminished buying power of the rand and a prolonged drought.November 2015 saw the worst drought in South Africa in 23 years. During this time Stats SA released […]

Retirement doesn’t happen at 65…

Retirement planning is only one component of a holistic financial plan and although retirement has a higher probability than all the other risk areas, this is the area we find people being the worst prepared for. Retirement doesn’t happen at 65… it happens when you make it happen!Planning for retirement is much like planning a […]

Retail Distribution Review – Prepare for advice fees

For the first time in South Africa, financial advice is set to become a billable service. Known as the Retail Distribution Review (RDR), the first phase will be implemented later this year (2016), introducing some significant changes for both consumers and financial advisors alike.As with all change, some sound preparation and a positive outlook will […]

Surviving the weak Rand

South Africa’s weakened Rand is bound to have a negative rippling effect on our economy. The cost of food, electricity, water and imported goods are all set to rise. Now is as best a time as any to take secure control of your finances.Budget According to the National Credit Regulator (NCR), as at June 2015 […]

Three Trends set to Shape Professional Industries

I found a great article talking about some of the major themes that are predicted to influence professional industries this year. A big part of running a successful business is staying up-to-date with current trends that are affecting the marketplace.Here are three trends that are set to be prevalent this year:Trust as the key competitive […]