When we experience our first crisis, we think our world is about to end. It could have been our first unrequited love when we were 12, a rejection letter from an application when we were barely out of our teens, bad news from the doctor or an accident that leaves us dealing with a deep […]

Category Archives: Blog

Have you been offered early retirement? (Part 2)

Following on from the previous blog on considering early retirement, the focus of this conversation sparker is to look at five key things that should be on our to-do list before we make any decisions about our retirement (or any big life decision!). In his article for Glacier, Dinash Pillay, National Business Development Manager at […]

A round tuit – and a bit about dread disease cover

There’s a rare object known as a tuit. It’s a special gift to keep for yourself, but also has great value for your friends and family. Tuits, especially round ones, will generally have a note or inscription along the following lines: This is a Round Tuit. Guard it with your life! Tuits are hard to […]

Have you been offered early retirement? (Part 1)

For many years we’ve been having better conversations about retirement. It’s no longer a matter of finding a job, staying in it for 40 years, and then retiring for fifteen years under the assumption that the company pension scheme will finance that entire period for us. It simply doesn’t work that way anymore. Finding a […]

Designing Your “No Rules Retirement”

Our concept of retirement is undergoing a metamorphosis. Demographic, societal, and workplace trends have all converged to offer a stage of life—at mid-life and beyond—that is much more fluid and flexible than we previously thought possible. When planning for retirement, we are discovering that the “old rules” have been thrown out and that “no rules” […]

Fortify financial peace of mind

There are few things worse than lying in bed at night, tossing and turning over financial stress. Lack of sleep only adds to our stress and hinders our overall mental, physical and emotional health! Our money choices are linked to our life choices, and our life choices are linked to our money choices. This means […]

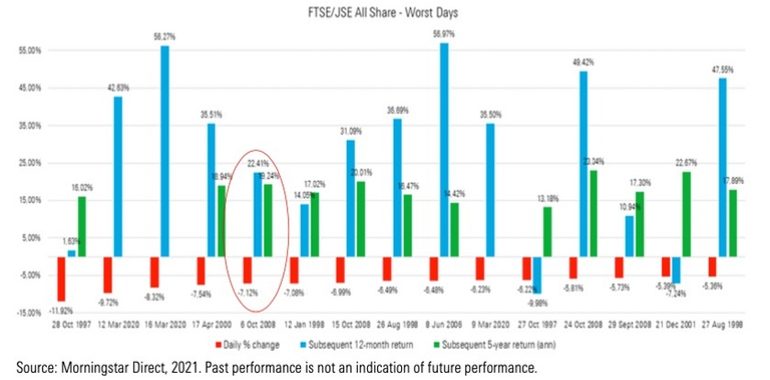

A powerful mental trick to master the markets

If someone is selling something, their primary goal is most often to convince you to buy what they’re selling. If you follow financial accounts on social media, your timeline is likely crowded with people touting the next big winning investment. As we look back on market history, there is an obvious attraction to finding the […]

How to nurture financially savvy kids

In 1988, financial planner and best-selling author Venita Van Caspel wrote in her bestselling book Financial Dynamics for the 1990s: “Our educational system continues to send forth our young with so little information about financial matters that they are like time bombs about to destroy their own and their families’ economic futures. We equip them […]

How does the stock market work?

The fastest way to lose half of your money is not a stock market crash but a divorce, separation or a poor business decision (so it’s a good idea to make sure you’re on the same page with your partner when it comes to joint finances.) Many have felt disheartened by the stock market in […]

When the opposite is true

There is a thin veneer over everything. When we are distracted by news streams, overwhelmed by direct messaging and tired from keeping up with the Joneses, it’s easy to create a veneer that allows us to store and process more information without having to delve deeper into what’s actually going on beneath the surface. It’s […]