As the earth’s axis tilts, heralding the onset of new seasons across the globe, there’s a palpable shift in our surroundings. When the Northern Hemisphere prepares to embrace the comforting embrace of autumn—donning sweaters and sipping warm beverages, the Southern Hemisphere is on the cusp of spring, promising rejuvenation and vibrant blooms. These seasonal shifts […]

Category Archives: Blog

The rising currency of human skills

Information is at our fingertips, and artificial intelligence continually surpasses human capabilities in specific tasks; the landscape of valuable skills is evolving. According to Dr Susan David, while technical know-how remains crucial, it’s quickly becoming commoditised. As a result, the pendulum is swinging towards the intrinsic value of distinctly human skills, finding and forging moments […]

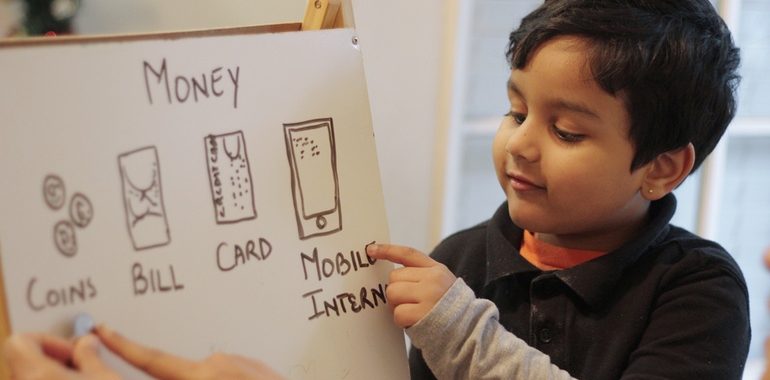

How talking about finances shapes our wealth

The Power of Conversation When we think about building wealth, our minds often dart to the tangible components: investments, savings accounts, real estate, and other assets. Rarely do we consider the intangible elements, especially the conversations we have about money. Yet, it’s these very discussions that have a profound impact on our financial trajectory. From […]

Time to think about money – Part 3

Trust is a crucial component of any successful financial relationship. Trust plays a huge role in making things work, whether it’s with your spouse, financial advisor, or business partner. And one way to build that trust is through the art of listening, which is a central idea in Nancy Kline’s Time to Think methodology. As […]

The significance of money scripts

It’s fascinating to see how the world of financial planning is evolving. Today, more than ever, there’s a growing acknowledgement of the role psychology plays in our financial lives. A prominent voice in this field is Dr. Brad Klontz, a clinical psychologist who’s been shining a light on what he calls our “money scripts”. Imagine […]

Creating a new financial narrative

In a few recent blogs, we’ve considered our money stories and how we can not only route out false narratives but work towards creating new financial stories. After exploring the emotional aspects of your financial health and understanding your money story, it’s time to create a new financial narrative that fosters a healthy money mindset. […]

How your communication style can empower your financial future

Navigating the world of personal finance is often as much about effective communication as it is about understanding the technicalities. Whether you’re conversing with a financial advisor, a spouse, or even yourself, how you communicate about money matters a great deal. How we discuss and perceive our financial circumstances can significantly affect our decision-making, emotional […]

How automatic thoughts shape our financial habits

Automatic thought patterns are pervasive and impactful, influencing our moods, behaviours, and even our self-concept. In our everyday lives, we sometimes struggle to recognise their presence in our decision-making, especially when it comes to financial choices. These automatic thoughts – images, words, or other mental activities – that pop into our minds in response to […]

Accountability: Your secret weapon for financial success

The financial world can be complex, teeming with jargon, concepts, and strategies that can bewilder even the most diligent among us. One aspect of navigating this labyrinth that often gets overlooked is the importance of having an accountability partner who can offer support, challenge you, and help you stay on course with your financial goals. […]

Unearthing the roots of your money story

Money, it is said, makes the world go around. We use it daily, exchange it for goods and services, save it for the future, worry about it, celebrate it, and yet often, we are reluctant to delve into our personal histories with it. Our earliest memories of money can reveal much about our present-day financial […]